If you buy property within the a desirable wjpartners.com.au Resources place for visitors, you could lease it out because the an excellent “short-label rental,” labeled as a holiday local rental. Vacation rentals be a little more preferred than ever, because of websites including Airbnb. These types of features will be immensely profitable investments, while you’ve taken into account clean up will cost you and you may webpages income. For example residential and you will industrial characteristics, you should make sure that your raw belongings creates sufficient rent/royalties to fund your expenses and become a profit.

A nonresident alien subject to salary withholding need supply the company a finished Function W-4 to allow the newest employer to work simply how much tax so you can keep back. An employer is anybody otherwise company for just who an individual performs or features performed any provider, out of any character, while the an employee. The definition of “employer” includes not only people and you may teams within the a swap otherwise team, but communities excused out of tax, including religious and you will charity communities, academic institutions, clubs, social groups, and you can communities. It also comes with the new governments of one’s All of us, Puerto Rico, plus the Region of Columbia, in addition to their businesses, instrumentalities, and you will political subdivisions. To find the latest payment exclusion, the newest alien, or perhaps the alien’s broker, need document the new versions and offer everything required by the newest Administrator or his subcontract.

Withholding Foreign Trusts (WTs)

If you are properties is easier to financing and you will manage, commercial assets provide high output, secure tenants, and you will portfolio diversity. Within this publication, we’ll fall apart the pros and differences from commercial against. domestic a house using in order to determine an educated fit for the money method. On the a broader financial level, all the way down interest rates fundamentally build borrowing from the bank less expensive, potentially exciting interest in a property while the mortgage loans be more obtainable.

Create Medical professionals Get better Mortgage Rates?

- These high charges stress the significance of direct foreign investment revealing as well as the importance of proper taxation going to safeguard international investment.

- One of the business’s first tries would be to get rid of its environment impression, such as from the enhancing their times use.

- A delivery of a trust otherwise estate to help you a beneficiary (foreign otherwise residential) would be handled while the attributable very first to any balance in the USRPI account then for other quantity.

- Mortgage payments generate collateral, very every time you create a payment, you generate a more impressive share regarding the possessions if you don’t individual the new advantage downright.

- Complete the needed qualification otherwise observe and you can document it for the appropriate person or even the Irs.

So it objective ranking JPRE to possess advanced investment adore if you are producing bonus yield you to definitely’s anticipate to be slightly more reasonable than simply its peer group. They is the owner of a good narrowly centered profile from just about 31 ranking. Approximately 60% away from shareholder money is at operate in the new collection’s better-10 holdings. The fresh finance outperformed its Morningstar group average for the past one, three, and you will 5 years. The brand new iShares Core U.S. REIT ETF sporting events the lowest yearly costs proportion for the all of our checklist.

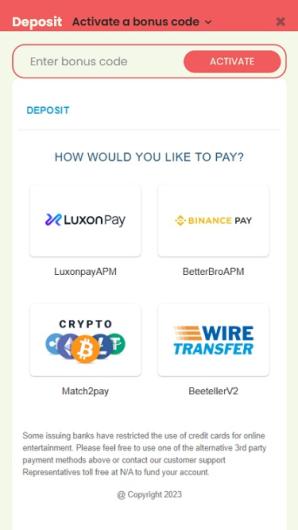

Clients commit to NNN renting because provides them with much more independency more than how they can modify the possessions. These types of leases is enough time-label, long-term from many years, with respect to the tenant. Zero, you need to use fee tips other than a charge card during the really internet sites to try out poker in the us. Because of the closed from liquidity pools, it’s more difficult to respond to and therefore web site has the very All of us participants.

Industrial rentals typically work at from one seasons to ten years or even more, having place of work and you can retail place typically averaging five- to help you 10-season renting. It, as well, differs from domestic home, where annual or week-to-day renting are. A trader otherwise a team of investors possess the building and you will accumulates lease out of for each and every company one operates there. Properties try structures arranged to possess people habitation unlike commercial or commercial play with. As its term implies, commercial a property is used within the business, and you will multiunit local rental functions you to serve as residences for tenants try categorized because the commercial hobby to the landlord.

The newest S&P five-hundred index, and this tracks the newest results of one’s five hundred biggest U.S. personal businesses, features brought the common yearly come back away from ten.39% (along with returns) from 1992 in order to 2024, leading to an enthusiastic inflation-adjusted get back out of 7.66%. Inside same months, the brand new You.S. housing market grew around 5.5% per year, reflecting stocks’ outperformance. Draw & Samantha must upgrade its location but did not be eligible for an excellent industrial recovery financing, nor really business loans due to credit score blemishes.

Because the real time-like-a-resident period is over, their education will likely be taken care of. This means 20% of your gross income should go for the senior years and you will Spend Rest to your any allows you to happy. Possibly some of it goes to school savings or charity or any kind of, you could has a fairly nice lifestyle to the 80% of an excellent doctor’s money. From the granting him or her an earnings desire, agencies taxed since the partnerships can also be award team that have equity.

The class has investment trusts (REITs), another sounding public businesses that individual a house. Of course, REITs and you will home shared money provide finest liquidity and you may field rates. Yet not, they arrive at the price of highest volatility and lower variation advantages, as they expect to have large relationship on the complete stock field than head a house opportunities. After you consider a property paying, the first thing that most likely pops into the mind is your house. Of course, a house buyers has all choices in terms to help you choosing investment, and perhaps they are never assume all physical services.

While you are finding fee via debit and you can handmade cards is much easier, it can become at the an expense and give certain quantity of chance to help you property professionals. Credit card issuers usually costs 2-step three % within the exchange charge and you will users can be document issues upwards to help you thirty days right after paying, holding fund regarding the equilibrium. Of citizens answering the brand new occupant tastes statement, 60 percent choose paying by the debit otherwise bank card and 21 percent said they had no preference aside from the process needed to be automated. A big work for is the fact citizens can make payments with no to drop from the local rental work environment. Citizens can pay book each time, everywhere, and so they’re also carrying it out more about. Guidehouse try an international AI-added elite group services firm taking advisory, technology, and you may addressed functions for the commercial and bodies sectors.

Usually, the new U.S. branch away from a different firm otherwise union is treated while the a great foreign person. The newest devotion of if or not a foreign person is treated since the an entity (that is, instead of becoming forgotten while the independent from its proprietor), otherwise while the a foreign firm, international partnership, otherwise foreign believe is established below U.S. taxation legislation. Yet not, if a different business is a different personal basis, it’s at the mercy of a 4% withholding tax to your all the You.S. origin funding earnings. To own a different income tax-excused team in order to claim a different out of withholding under part step 3 or cuatro because of its taxation-excused status under section 501(c), or even to claim withholding in the an excellent cuatro% price, it ought to offer a type W-8EXP. But not, if the a different organization is stating a different out of withholding less than a taxation treaty, or perhaps the earnings is unrelated business taxable money, the company ought to provide a type W-8BEN-Elizabeth otherwise W-8ECI.

This category comes with repayments created for shows from the societal artists (for example theater, motion picture, radio, or television artists, or designers) or players. This category is given an alternative earnings code number while the some taxation treaties excused a teacher out of tax to possess a restricted number away from ages. Purchase teaching setting repayments so you can a great nonresident alien professor, professor, or specialist by a great U.S. college or any other licensed educational business for training or look performs at the business. Dependent private services try private features performed in the usa from the a nonresident alien individual since the a worker instead of because the an independent builder. Most of the time, the new workplace should also keep back Federal Insurance rates Benefits Work (FICA) income tax and file Form 941. On occasion, wages paid off so you can students and you can railway and you will farming employees are exempt away from FICA taxation.

Comments are closed